Creating Returns Using the Main Information Worksheet

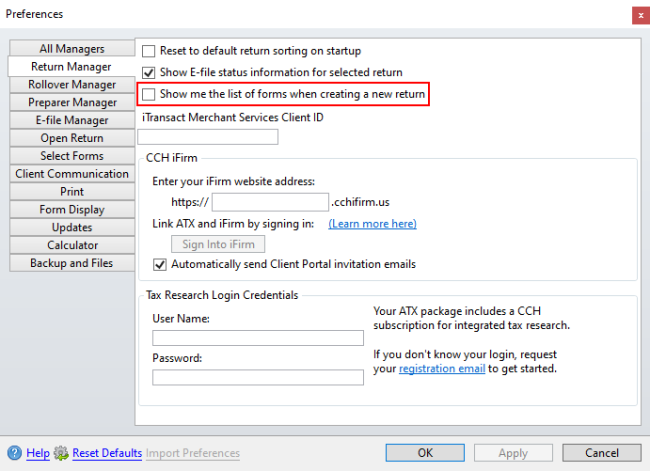

To create returns using the Main Information Worksheet verify the "Show me the list of forms when creating a new return" check box is cleared in the Return Manager Preferences. This check box is not selected by default.

Return Manger Preference is cleared

To start a new return:

- From Return Manager, do one of the following:

- Click the New button on the toolbar.

- Click the Returns menu; then, select New Return.

- Press Ctrl+N.

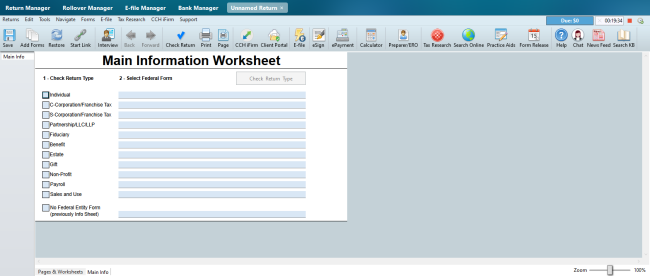

New return

- Select the check box indicating the type of return.

- Select the Federal form for the return from the drop-down list.

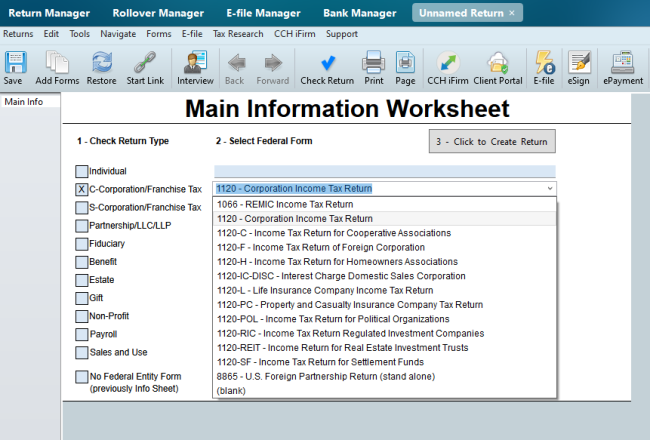

Example of drop-down for Federal Form

- Click the Click to Create Return button.

If you use CCH iFirm you are able to import client contact information when starting a new return. See Import CCH iFirm Contact Data into a New Return

- Enter the demographic information on the Main Information Sheet.

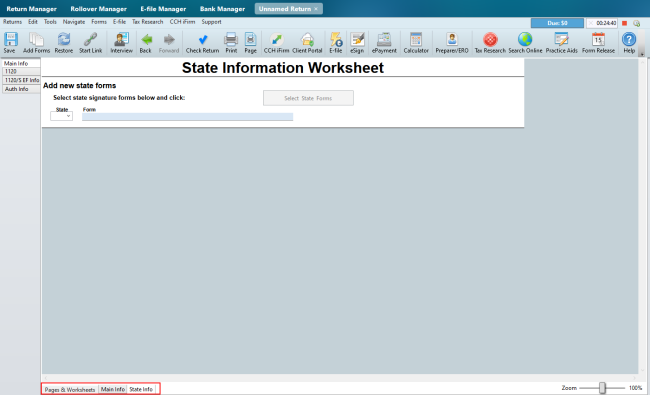

- Click the State Info tab to add a state to the return.

The client data will flow into all forms in the return plus insert appropriate forms based on the client's data.

Example of State Information Worksheet

- Click Add Forms to add any additional forms.

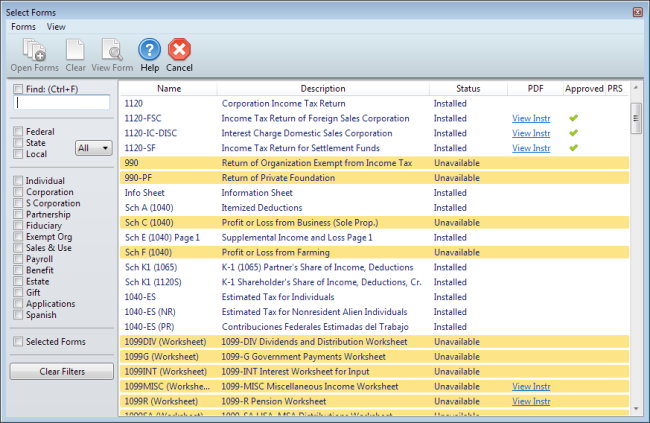

Select Forms dialog box

- Highlight the form(s) you want to add to the return.

To select multiple forms, simply click each desired form.

- Click the Open Forms button on the Select Forms toolbar.

If you use CCH iFirm you are able to import client contact information when starting a new return. See Import CCH iFirm Contact Data into a New Return.

- Complete the necessary tax form(s).

To save the new return:

- Do one of the following:

- Click the Save button on the toolbar.

- Click the Returns menu; then, select Save Return.

- Press Ctrl+S.

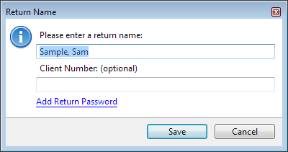

Return Name dialog box

By default, ATX names the return for the Taxpayer (and Spouse, if applicable).

- Do one of the following:

- Accept the default name and click Save.

- Enter a new name for the return; then, click Save.

See Also: